SOL Price Prediction: $250-$350 Bull Run Likely as Technical and Fundamental Factors Align

#SOL

- Technical Strength: SOL holds above key moving averages despite MACD bearishness.

- ETF Catalyst: 90% approval odds and institutional inflows drive sentiment.

- Price Targets: $218-$230 short-term; $250-$350 achievable with sustained momentum.

SOL Price Prediction

SOL Technical Analysis: Bullish Signals Emerge

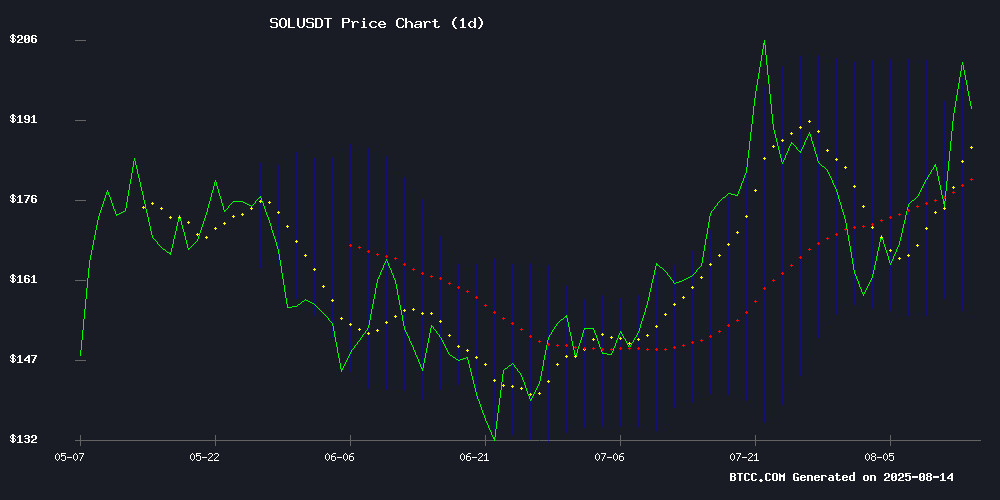

SOL is currently trading at $203.03, significantly above its 20-day moving average of $177.945, indicating strong bullish momentum. The MACD shows a slight bearish crossover with the MACD line at 1.9267 below the signal line at 5.2434, but the price remains resilient. Bollinger Bands suggest volatility with the upper band at $201.9455 and the lower band at $153.9445, while the middle band aligns with the 20-day MA. According to BTCC financial analyst Ava, 'SOL's ability to hold above $200 despite mixed technical signals suggests underlying strength. A breakout above the upper Bollinger Band could target $218-$230 in the NEAR term.'

SOL Market Sentiment: ETF Hype Fuels Rally

News headlines highlight SOL's surge past $200, driven by ETF approval speculation (90% odds) and institutional inflows. Titles like 'SOL Price Prediction: Targeting $218-230 Breakout' and 'Solana Surges Past $200 Amid ETF Inflows' reflect overwhelmingly bullish sentiment. However, cautionary notes like 'Market Hesitation Amid Mixed Signals' temper expectations. Ava notes, 'The ETF narrative is overpowering short-term technical resistance. If institutional adoption sustains, $250-$350 is plausible by Q4 2025, but volatility will remain high.'

Factors Influencing SOL’s Price

SOL Price Prediction: Targeting $218-230 Breakout as Technical Setup Aligns for August Rally

Solana's technical indicators suggest an imminent breakout, with $218-230 emerging as key resistance levels. The token currently trades at $205.95, testing upper Bollinger Bands while MACD momentum reinforces bullish sentiment.

Analysts converge on upside targets, with CoinEdition's $218 prediction and WalletInvestor's $245.547 high reflecting divergent risk appetites. Immediate support holds at $155.83, though the bias clearly favors upward movement.

Solana's Rally to $250 Faces Market Hesitation Amid Mixed Signals

Solana surged 18% to briefly breach $205, igniting speculation about a potential climb to $250. The rally, fueled by a 48% spike in network transactions and 43% fee growth over 30 days, contrasts with BNB Chain's 41% transactional decline. Yet fading DEX volumes and cautious derivatives activity cast doubt on sustainability.

Market capitalization now hovers near $107 billion—closing in on BNB's $117 billion—but the path to $250 lacks clear catalysts. On-chain strength battles macroeconomic hesitancy as traders weigh Solana's ecosystem momentum against broader crypto volatility.

Solana (SOL) Surges Above $200 as ETF Approval Odds Reach 90%

Solana's SOL token has reclaimed the $200 threshold, trading at $202.05 with a 4.05% gain in the last 24 hours. The rally follows a 15% surge yesterday, fueled by growing institutional confidence as Bloomberg analysts peg ETF approval odds at 90% by 2025.

Technical indicators show robust momentum, with the RSI at 66.24—bullish but not overbought. The breakthrough marks SOL's first return to this psychological level since late July, suggesting an end to its consolidation phase.

Beyond ETF optimism, Solana's ecosystem expansion continues with the 'Seeker' smartphone launch, building on the success of its Saga device. This hardware push demonstrates the network's ambition to transcend DeFi and capture broader consumer adoption.

Solana Price Volatility Sparks Investor Shift to High-Yield Alternatives

Solana's price decline to $174.90 has unsettled traders, despite an 8% monthly gain. The SEC's delay in approving Grayscale's SOL ETF until October 10 compounds market uncertainty, though analysts project a potential 5% rebound to $185 upon approval.

Amid the turbulence, Unilabs Finance emerges as a contender with its AI-driven platform offering 25% passive yields. The platform's promise of consistent returns contrasts with SOL's recent volatility, attracting investors seeking stability.

On-chain activity lags and FTX-related unstaking pressures continue to weigh on Solana. Market participants now face a choice between waiting for ETF-driven momentum or pivoting to alternative yield opportunities.

Solana Price Prediction: $200 Breakout Could Set Stage for $250–$350 Bull Run

Solana has surged 14.91% in the past 24 hours, reclaiming the $200 level with conviction. The move reflects renewed bullish momentum, backed by persistent buying pressure rather than fleeting speculation.

Technical analysis suggests a potential retest of $250-$265 if the current support holds. Analysts note a striking resemblance to previous breakout patterns, with an ascending triangle formation signaling further upside.

On-chain activity mirrors the price strength, indicating organic demand. The $200-$205 zone now serves as both psychological and technical battleground—a decisive hold here could validate the next leg of Solana's bullish cycle.

Pump.fun Regains Dominance as Solana Meme Coins Rally

Pump.fun has reclaimed its position as the leading token launchpad on Solana, ending LetsBonk's month-long reign. The resurgence follows strategic moves including the establishment of the Glass Full Foundation and a revamped social media approach.

Tokens originating from Pump.fun have surged 8% collectively, with Fartcoin leading the charge at a 15% gain. The meme coin now boasts a $1.08 billion market capitalization, dwarfing second-place Peanut the Squirrel's $263 million valuation.

The platform's native PUMP token has outperformed even Fartcoin, reaching a $1.3 billion market cap after a 12% weekly gain. This rally coincides with Pump.fun's $1.7 million ecosystem injection through its Glass Full Foundation initiative.

Solana Price Surges 13% in 24 Hours, Eyes $300 Target

Solana's price has surged 13% in the past 24 hours, breaking through key resistance at $195 and marking a 22% gain over the past week. The rally defied expectations of a slowdown, with bulls now targeting $300 as the next major milestone.

Technical analysis reveals a breakout from a converging wedge pattern, typically signaling trend reversals. The $195 level, previously a stubborn ceiling, now serves as support after SOL cleared the 0.786 Fibonacci retracement level. Chart patterns suggest potential upside targets at $237 and $287 if momentum sustains.

Market observers note the speed of the breakout, with liquidity building above $206 resistance. The move comes amid renewed institutional interest in layer-1 alternatives to Ethereum, though traders remain watchful for potential pullbacks.

Solana Surges Past $200 Amid ETF Inflows and Spot ETF Speculation

Solana's price rallied 15% in 24 hours, breaching the $200 mark as institutional interest grows. The momentum follows the July 2 launch of the REX-Osprey Solana + Staking ETF (SSK), which combines spot SOL exposure with staking rewards. With 57% of holdings directly staked and 42% in 21Shares' staking ETP, the fund attracted $151M AUM within weeks.

Early August saw a brief $2.7M outflow, but inflows rebounded sharply as crypto markets regained strength. The ETF structure allows traditional investors to gain SOL exposure without direct ownership, creating new buy pressure. Market participants now watch for potential spot Solana ETF approvals following Bitcoin and Ethereum's regulatory milestones.

Solana Price Targets $270 Amid Institutional Adoption Surge

Solana's price surged past $200, marking a 15% intraday gain as bullish momentum builds. Analysts cite technical patterns and institutional activity as key drivers, with short-term targets at $270 and long-term projections exceeding $1,300.

CMB International's tokenization of a cross-border fund on Solana underscores growing institutional adoption. The blockchain's DeFi activity and price action now reflect what analysts describe as a 'cup-and-handle' breakout pattern—a historically reliable indicator of extended rallies.

Upexi Strengthens Solana Strategy with Arthur Hayes on Advisory Committee

Nasdaq-listed consumer products firm Upexi has formed an advisory committee to oversee its $400 million Solana treasury strategy, tapping former BitMEX CEO Arthur Hayes as its inaugural member. The move signals deepening institutional confidence in SOL, with Upexi now holding over 2 million tokens—the largest corporate position.

SOL surged 15% to $201 following the announcement, extending weekly gains to 23% as its market cap crossed $108 billion. Hayes' involvement through his role at Maelstrom Fund brings institutional-grade crypto expertise to Upexi's acquisition financing and visibility efforts.

The strategic pivot reflects a broader trend of public companies allocating treasury reserves to alternative assets. Solana's proof-of-history blockchain continues attracting institutional capital, with its ecosystem now commanding nearly 10% of total crypto developer activity.

Solana Reclaims $200 Mark as Institutional Confidence Fuels Rally

Solana (SOL) surged past $200, marking a 14% gain in 24 hours as altcoin season momentum builds. The rally lifts its market cap above $100 billion, with Polymarket bettors pricing in an 84% chance of hitting $210—and a 43% probability of new all-time highs by 2025.

DeFi activity mirrors the bullish trend. Solana's TVL in SOL terms hit 58 million tokens, a three-year peak, while dollar-denominated TVL crossed $11 billion for only the second time this year. Its DEXs continue outpacing Ethereum for the tenth consecutive month.

Institutional inflows appear to underpin the resurgence, though the report cuts off mid-analysis of treasury-related activity.

How High Will SOL Price Go?

SOL's price trajectory suggests a potential rally to $250-$350 if key resistance levels break. Below is a summary of critical levels:

| Indicator | Value | Implication |

|---|---|---|

| Current Price | $203.03 | Above 20-day MA ($177.945) |

| Bollinger Upper Band | $201.9455 | Breakout confirms bullish momentum |

| MACD | -3.3166 (Histogram) | Short-term bearish but price resilient |

Ava emphasizes, 'ETF inflows and institutional interest could override technical resistance. Watch for a sustained close above $218 to confirm the $250 target.'